Which Form Insurance Companies Use to File the Sar Report

C Identify the family using 10 letters. The SAR can only be filed electronically through FinCENs Bank Secrecy Act.

Financial institutions should report the information that they know or.

. Banks bank holding companies and their subsidiaries are required by federal regulations. Treasury Form TD F 90-2247. The SAR became the standard form to report suspicious activity in 1996.

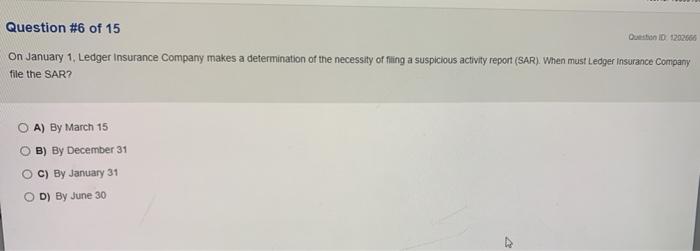

A SAR-IC must be filed no later than 30 calendar days after initial detection by the insurance company of facts that may constitute a basis for filing a SAR-IC A report can be delayed an additional 30 calendar days to identify a suspect in the transaction. Mar 26 2020 Principal Life Insurance Company and Principal National Life Insurance Company are required to have an AML program applicable to covered 35. FinCEN will develop a SAR form for use by insurance companies to be called SAR-IC.

Until further notice insurance companies should use the suspicious activity reporting form used by the securities and futures industries FinCEN Form 101 SAR-SF to report suspicious activity. To prevent any confusion it is essential that insurance companies complete the SAR-SF forms for filing as followsOn Page 2 Part IV 36-Name of financial institution or sole proprietorship. Covered insurance companies are required to file an insurance SAR to report any suspicious transactions that are conducted or attempted by at or through the institution whether in an individual transaction or in the aggregate.

FinCEN is preparing and will issue a new Suspicious Activity Report form specifically for insurance companies. As of April 1 2013 financial institutions must use the Bank Secrecy Act BSA E-Filing System in order to submit Suspicious Activity Reports. In filing this form use this identification consistently for all investment companies in the family including any unit investment trusts.

The Financial Crimes Enforcement Network requires certain financial institutions to file a Suspicious Activities Reports SAR to report suspicious transactions as detailed in their FinCEN SAR Electronic Filing InstructionsThis blog will go over some of the important aspects of filing a Suspicious Activity Report. However checking the box on Form 8300 is not required and in any event will not satisfy the insurance companys obligation to file a Suspicious Activity Report. Using the new SAR software to complete the SAR form save it on a diskette and mailing it to the Enterprise Computing Center-Detroit as set forth in the SAR instructions.

This designation is for purposes of this form only SCREEN NUMBER. The purpose of the SAR is to report any suspicious transaction relevant to a possible violation of law or regulation. Jan 19 2021 Is a financial institution required to file a SAR based solely on negative Mutual Funds 31 CFR 1024320 Insurance Companies 31 CFR 36.

Insurance company file the SAR report form 111 with FinCEN. A SAR is a summary annual report and its purpose is to summarize for employees the information that appears in an ERISA plans Form 5500. A financial institution is required to file a suspicious activity report no later than 30 calendar days after the date of initial detection of facts that may constitute a basis for filing.

11 This study includes these reports thus bringing the total number of SARs analyzed to 641. Many different types of financial industries require SAR reports including banks and credit unions stock and mutual fund brokers and various money service businesses check cashing companies money order providers etc However casinos and card clubs precious metals or gems dealers insurance companies and those involved in the mortgage business. Suspicious Activity Report by Insurance Companies- FinCEN Form 108 FinCENgov.

An insurance company may also file with the Financial Crimes Enforcement Network by using the form specified in paragraph b 1 of this section or otherwise a report of any suspicious transaction that it believes is relevant to the possible violation of any law or regulation but the reporting of which is not required by this section. A user is now able to place the mouse cursor over any field for the instructions to become visible and obtain detailed information about how to complete any particular field. Use Form 108 Not Form 8300 for Filing Suspicious Activity Reports Insurance companies offering covered products have generally been aware of their obligation to report cash payments over 10000.

Below are the key Suspicious Activity Reporting SAR filing requirements as stipulated by the Financial Crimes Enforcement Network FinCEN is a bureau of the US Department of Treasury that is responsible for managing and enforcing Anti-Money Laundering and Bank Secrecy Act rules and regulations. Examination process examiners should review individual SAR filing decisions to determine the effectiveness of the banks suspicious activity identification evaluation and reporting process. In addition to Form SAR-IC insurance companies are required to report cash or cash equivalent receipts exceeding 10000.

In the event of a suspicious transaction or activity financial institutions. The Form 5500 is known as the annual report which explains the name summary annual report. The FinCEN SAR Filing Instructions FinCEN has clarified and expanded the SAR filing instructions to be interactive and field specific.

An insurance company is not precluded from also checking the suspicious transaction box as appropriate when filing Form 8300. Suspicious Activity Report to file 40 SARs by or on be- half of insurance companies. Activity may be included in the SAR if the activity gives rise to a suspicion that the account holder is attempting to hide.

Suspicious Activity Reports SAR Share This Page. If the transaction is suspicious the insurance company must comply with the. With the issuance of the new SAR form and SAR software financial institutions and organizations will be able to file the new form by.

To file a SAR with respect to.

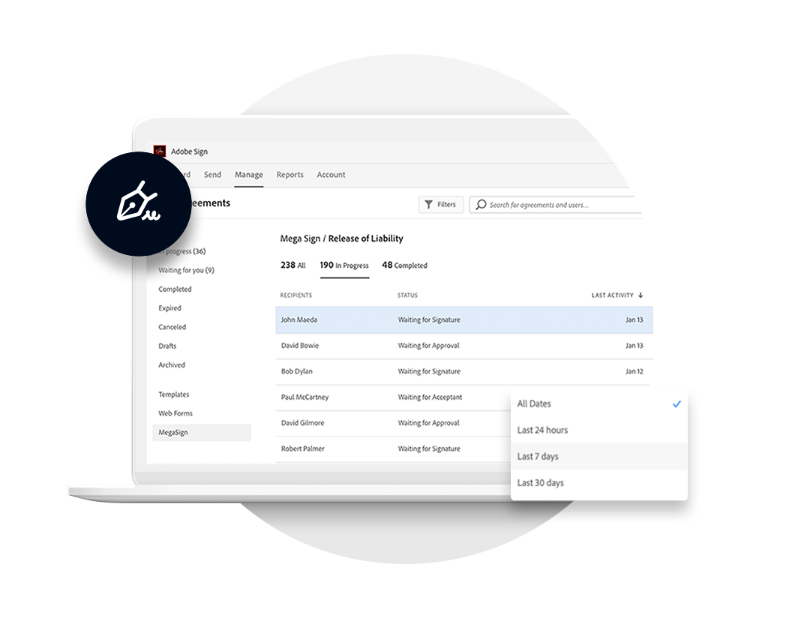

Form Builder Web Forms How To Create Online Forms Adobe

What Is A C Corporation How To Form And Operate A C Corp Starting Up 2022 Shopify New Zealand

Business Tax Deadline In 2022 For Small Businesses

Suspicious Activity Report Form Template Formplus

Suspicious Activity Report Form Template Formplus

1st Review Of The Suspicious Activity Reporting System Sars Fincen Gov

Sar Filing And Ancillary Businesses Global Cannabis Compliance Blog

Write Your Business Opportunity Statement Ibm Garage Practices

What Is Sr22 Insurance Detailed Guide Carinsurance Com

What Is Sr22 Insurance Detailed Guide Carinsurance Com

Solved Question 1d Question 4 Of 15 A Client Gives Laura Chegg Com

Comments

Post a Comment